Boston Consulting Group (BCG) just released a report called 2014 BCG Global Challengers which lists the top 100 fast-growing and formidable companies from emerging markets. It’s their 6th study and argues these companies are not only growing, but reaching a new level of maturity. Jumping to the next S-curve.

- Fewer companies fell off the list, implying they are stronger and stable

- More retail companies, indicating more purchasing power from emerging markets

- Five companies graduated from the list, because they are now global leaders

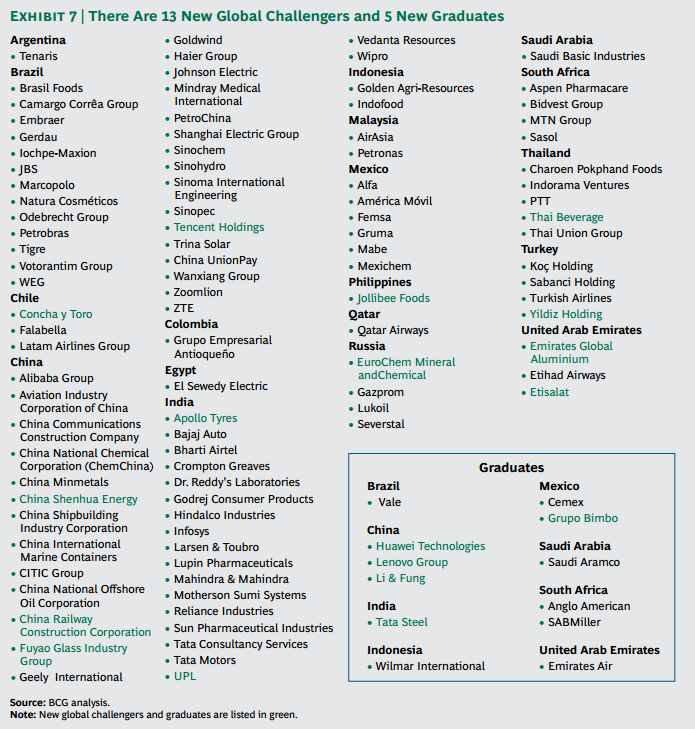

The top 100 global challenger list

These companies are impressive in their breadth, speed, and cost-competitiveness. While I am not the most global traveler or investor, I recognized 22 of the top 100 and recognized all of the 12 that graduated the list.

What are they doing right?

- Capturing middle class consumers – from 2009 to 2020, the global middle class is expected to expand from 1.8 billion to 3.2 billion, almost entirely coming from the emerging markets; monster growth

- Meeting digital needs – New companies do not have the legacy infrastructure that prevents them from moving faster; asset-light technology also allows them to scale globally faster. Multiple examples from the telecommunications industry

- Building and supplying the world – This is familiar story line; local natural-resource companies develop a local monopoly and scale globally.

- Growing through acquisitions – As just one example, Tencent (Chinese internet company) made 100 overseas acquisitions in the last few years.

End of easy growth

BCG argues that it will get harder for these fast growth companies as they expand beyond their local (often protected) markets. Unsurprisingly, as these challengers grow, they become more like the staid, inert global Fortune 500 companies they were beating. The teenager becomes like his/her old parents.

Two markets

BCG argues that the dichotomy between the two markets is stark and growing. 1) A slow-growth, somewhat homogeneous mature market 2) A set of fast-growing, volatile, diverse, local markets. Simple, makes sense.

They note that it is difficult for companies on either side of the fence to transition to the other side. In fact, many emerging challengers are opting to grow into adjacent emerging markets, rather than over-extending into mature markets.

How to growth from a challenger to a leader?

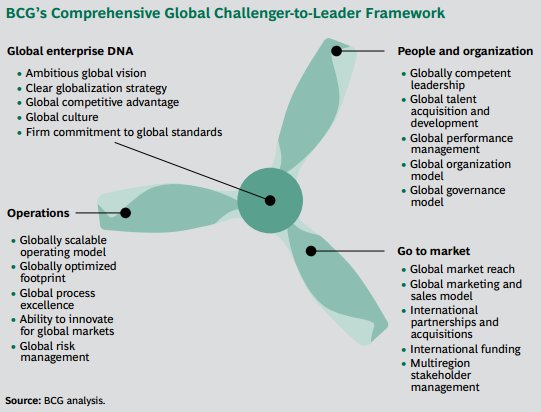

Glad you asked. BCG provides a clever way to visualize what it sees as the four ingredients to help these companies jump the S-curve.

- Global enterprise DNA – know who you are and what you are trying to do

- Operations – Scaling up with concrete processes + flexibility to adapt

- People and organization – As Jim Collins says, “Get the right people on the bus”

- Go to market – Knowing that the customer will tell you what they like

Alibaba

Lots of talk of this profitable Chinese internet giant last week. One of the largest IPOs in history, 100% growth YoY in revenues, and 40%+ margins. Trust me, you will see a lot more of these ground-breaking IPOs in the near future.