This is a quote first attributed to Dan Montano in the Economist, but was popularized by Thomas Friedman in The World is Flat. Here is the full quotation here:

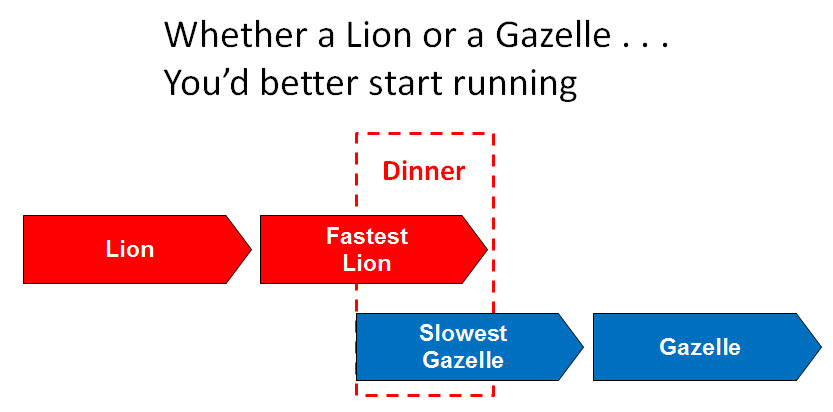

Every morning in Africa, a gazelle wakes up. It knows it must run faster than the fastest lion or it will be killed.

Every morning a lion wakes up. It knows it must outrun the slowest gazelle or it will starve to death.

It doesn’t matter whether you are a lion or a gazelle: when the sun comes up, you’d better be running.

For libertarian-types like me, this quote pretty much sums up how we see the free markets. It’s a wild, open, competitive, and oddly democratic way to get the best out of people. Money is certainly not everything, but the market has a queer way of rewarding those – in the long run – who are good at what they do. Whether you are a lion or a gazelle, you had better be running.

The average S&P 500 company only lives 18 years

While humans live longer, companies don’t live as long as they used to. In 1935, the average company lived 90 years. Harvard Business Review calls this corporate endurance here. McKinsey argues here that you really have a choice of innovating or dying here.

90% of profits only go to the top 20% of companies

This is something Dominic Barton – global head of McKinsey – said recently in the press here. I am looking up the data on that, but he is no fool, so I am taking it as gospel. In short, winner takes all.

This echos the strategy that Jack Welch pursued in the 1980s and 1990s when he stated that General Electric would get out of any industry where it could not be #1 or #2. It is also consistent with the main thesis of my favorite industry strategy book called The Rule of Three – by Professor Jag Sheth which argues that all industries go towards oligopoly; as companies grow and merge to get scale, industries continue to consolidate until there are 3 major competitors, and a long list of niche or smaller players.

It doesn’t matter whether you are a lion or a gazelle: when the sun comes up, you’d better be running.

2015 was a record year for mergers and acquisitions

Not sure if your noticed, but 2015 was a monster year for investment bankers. There were $4.7 trillion of M&A deals, up 42% from 2014. The Atlantic magazine notes here that companies had a lot of cash, they are getting more confident after the recession, and they are looking to get economies of scale to squeeze out costs. Here are some of the 137 mega-deals (deals over $5 billion) from last year which accounted for more than 1/2 of the total deal value:

- AB Inbev + SABMiller ($120 billion)

- Pfizer + Allergan ($191 billion)

- DuPont + Dow Chemical ($68 billion)

- Charter + Time Warner ($78 billion)

- Dell + EMC ($66 billion)

- HJ Heinz + Kraft ($55 billion)

- Anthem + Cigna ($48 billion)

VUCA

This is an acronym from the US military that stands for Volatile, Uncertain, Complex and Ambiguous. Situations are fluid. Multiple – unrelated things – can go wrong. Strategic flexibility is critical to having a good set of options. Even McKinsey says that 40% of the services they deliver to clients within 3 years time will be completely different from what they do now. Innovation, speed, and flexibility is the mantra of high-performing companies today.

- What are you and your company doing to disrupt yourself?

- What are you doing to run faster?