McKinsey 120 page report on the digitization of America

Some critics might argue the two main arguments are a bit obvious: 1) digitization drives productivity and 2) those gains are shared uneven across industries, companies, and people. It is a story of the digital divide – the “haves” and the “have mores”.

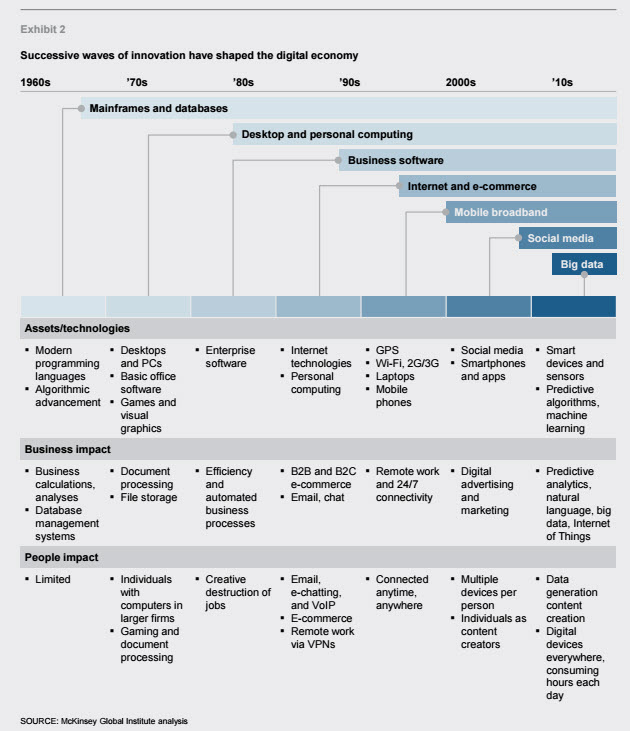

On the surface this is not surprising, right? Moore’s law has been driving productivity for the last 30+ years. See a good summary of that point from the report below (page 33). There are waves of technology – honestly – starting WAY before the advent of the microprocessor – Archimedes, Ptolemy, Faraday, Marconi to name a few.

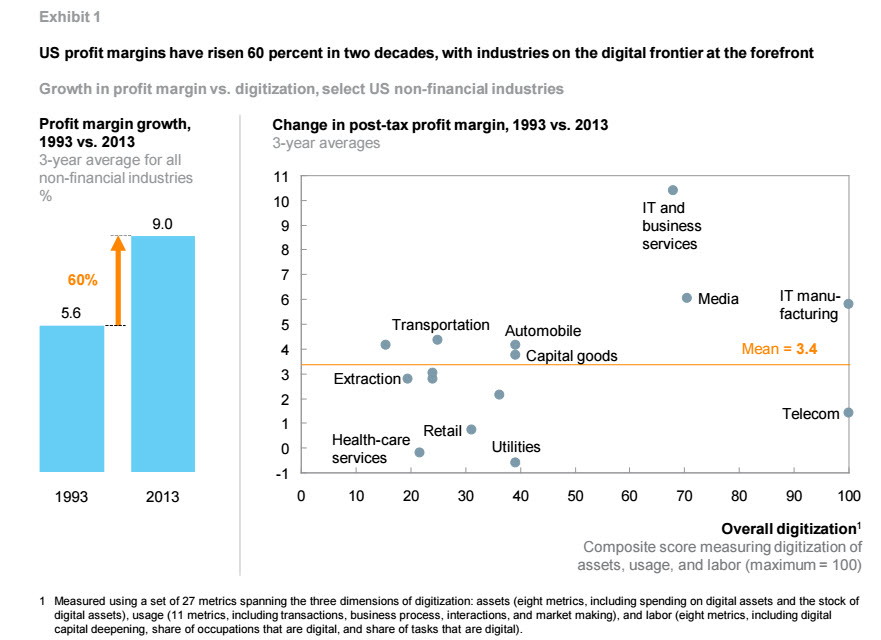

Digitization drives profits

Technology drives innovation, new products, fascinating applications, better allocation of fixed assets, and in many consultants’ cases. . . saving you time. McKinsey shows in the graph below that over a 20 year time frame, the profit margin of non-financial industries grew from 5.6% to 9.0%, and those gains were not shared evenly across industries. Michael Porter’s industry attractiveness exercise.

IT manufacturing, Media and IT services grew profits the most spectacularly as seen in the graph below. Just as fascinating, is the fall of Telecom growth as the “old” technology got cannibalized by newer cell phone, and VOIP “newer” technology. The gains are not shared. “Haves” and “Have mores”

What I think is more remarkable, is how management consultants – in this case McKinsey – can take an immeasurably broad and amorphous topic as digitization driving productivity and make something actually readable. It’s all story-telling.

Put things in buckets

For anything vast, chaotic, inter-related, complex or messy – one of the key tenets of consulting is bucketing. Yes, bucketing. It forces you to think about the problem – isolate the drivers, assumptions, trends, and outliers. McKinsey does exactly that by breaking down the data, building it back up again with hypotheses and testing those recommendations. Standard consulting fare.

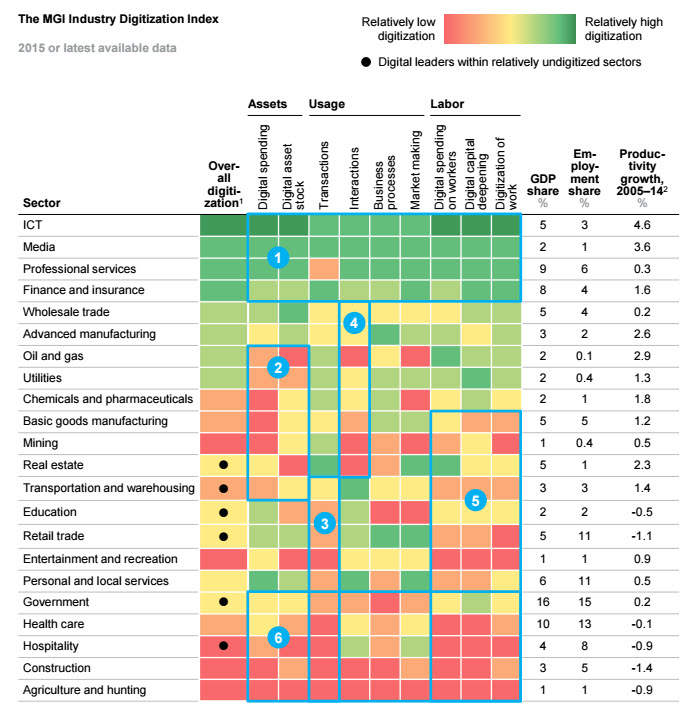

Digital assets, usage, and people

The first thing McKinsey does is categorize digitization into three major buckets (assets, usage, and people), which of course can be broken down further (page 15). Then they put the sectors on the left, rating the level of digitization from high to low. The sectors with lots of green are highly digitized, while those in yellow and red are not. Judging from the % share of GDP and employment, a lot of the laggards toward the bottom (especially government, healthcare) have the most to gain marginally from digitization. Large parts of the economy are not productive.

Are in one of the industries shown in red color above?

If so, you really need to think:

- Am I a change agent? Am I aggressively driving technology into this analog, slower-growth industry? Am I coasting along, or making a digital impact?

- Do I just love this industry and don’t mind an industry with lower profits, and honestly, less upside wage potential?

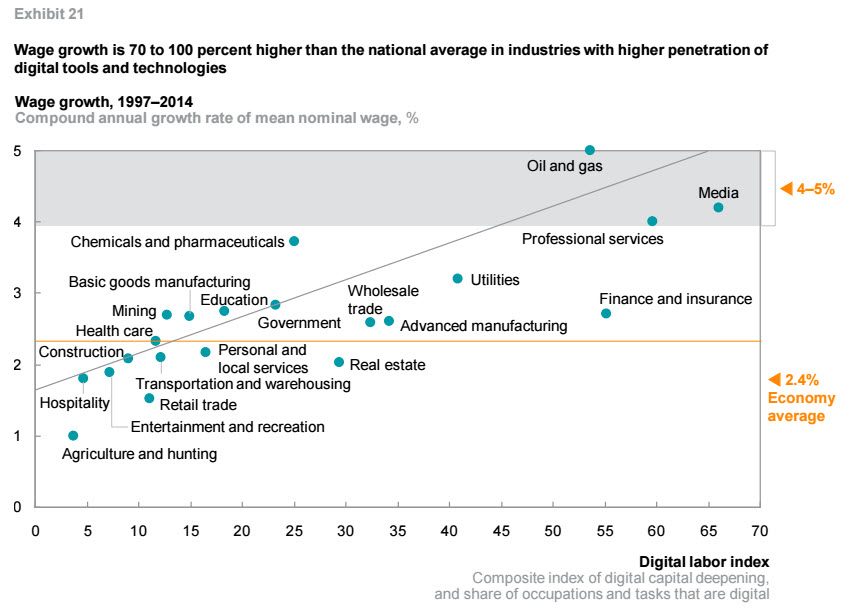

The less digital the industry, the less it pays. BOOM

See the chart below, it’s incredibly important. Digitization = productivity = higher value per asset, per person, per hours = higher wages.

Power shifting to platforms and consumers

In the old day, the manufacturer or the supplier had the asset and the power (think Marx). Not any more. Platforms – Facebook, Linkedin, AirBnB – create value from synthesis, comparison, and navigation of choice. In the US, everything is so abundant that the scarcity is time. Platforms and digital intermediaries save people time. . Yelp, Uber etc.

Platform economics

This combines low marginal costs with the growth from network effects. McKinsey notes that within 10 years, Facebook has more users than the population of China. BOOM. low cost + network = hyper growth.

Traditional intermediaries get disrupted

Insurance broker and travel agent are two examples of jobs that are fast disappearing. McKinsey notes that from 2000 to 2014, online travel booking increased 10x, but the # of agents dropped by half.

Are we at peak-digitization?

Digitization drove enormous growth in the 1990s, less in the 2000.McKinsey admits that productivity in the US slumped dramatically in the 2000, bringing up the question of peak-digitization.

But it took 15 months to restore lost jobs after the 1991 recession, 39 months after 2001, and 43 months after 2008. Large companies in particular now respond to downturns with a push to improve productivity—not by increasing output and innovation but by cutting employment

The robots are (kind of) taking over

Some of the messaging is depressing, even to libertarians like me. Too frequently, companies are getting more productive – not by creating more output – but instead, by reducing the human inputs. The thinking goes. . .”well, since we are stuck with this market share, and these products/services, I guess we can at least just cut costs.” It’s generally uninspired thinking, and honestly, you cannot cut your way to prosperity.

More work for more people

One win is that more people can participate in the workforce – people in far off places, people with low marginal opportunity cost of time (read: poor), people who might traditionally not be able to contribute (e.g., physical disabilities). Technology helps to flatten the field – turn everything into a global field.

Better use of resources

The Internet of things (IOT) holds the promise that connected devices will make our lives better – by tracking data, getting smarter over time, and optimizing usage. While consumers are just now getting a taste of that now (Google’s Nest, Tesla cars), large industrial companies like GE, Siemens, Philips, Rolls Royce have been doing remote diagnostics and smart connected devices for decades.

Smart supply chain

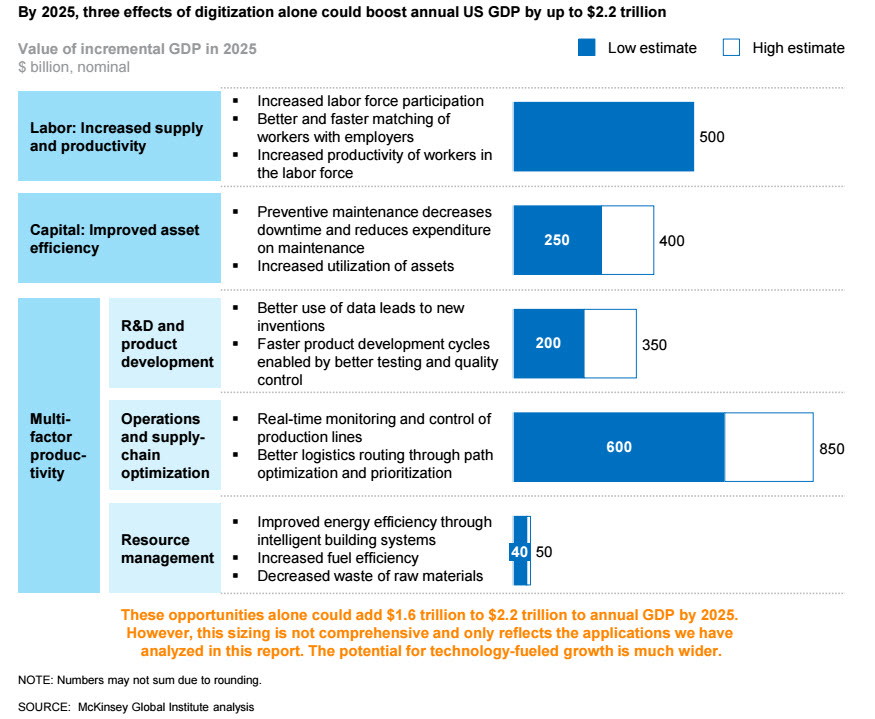

Here is where McKinsey makes a bold prediction. They say that digitization can boost US GDP by 2.2 trillion. A good portion of this comes from a smarter supply chain. This makes sense because in the simple macroeconomic formula for GDP (C+I+G+NX), a lot of that is honestly supply chain.

Whenever you go to the store to buy something it has changed hands hundreds of times likely coming from China to boat to a train to a truck to a warehouse to a store. The low price of oil right now probably masks this latent inflationary ingredient. Once all prices go back up everything is going to get more expensive to get you.

It is all changing

In true Schumpeter style, the APPLICATION of technology continues to evolve. . .just with the late majority start to pick up on the use of technology BOOM – the technology chasm moves again. Like the gazelle and lion quote, technology is helping people and companies run faster- with or without you.

The “have-mores” continue to push the boundaries of digitization, particularly in terms of augmenting what their workers do, while everyone else scrambles to keep up with them.

Startups = technology farm teams

Perhaps this is why large, stodgy companies are buying start ups. Rather than merely throwing money at ideas and basic research, they can pick up promising technology AND the people once vetted by the market. These valuations are not cheap – very susceptible to hype and bubbles; just look at the unicorns – privately held companies purported to have valuations of $1billion here.

Where do you fall on the digital industry spectrum?

Really enjoy your blog and wonder at the fact you can find/take the time for this. Thanks!!

From a personal perspective I am old enough to have gone through most of the stages of this stuff. As a professional services person I have gone from dictating and mailing tapes to a typist, proofing and re-mailing etc to doing all work via email, internet, cloud teaming and voip. Travel has been reduced by 80% and I book and manage that all myself. I do most of my work out of a home office or Regus sites….okay……some Starbucks too. Mobility and networks are the greatest change….my first computer was the size of a hot air furnace and took floopies that were 6″6″ and gave off so much heat I had to leave the room every 15″ to cool off.

Have been disappointed that manufacturing supply chain clients have not instituted much that is possible in spite of OEM pressure….many just catching on to Kanban and process flow stuff.

Thanks again, your stuff is insightful, interesting and makes me wish I was starting over instead of shutting down.

Thank you for reading. Enjoy connecting with people like yourself – structured thinkers, management “doctors” and the intellectually curious. Great perspective – life is all about story-telling, and your vignette about 6’6″ floppies going into a furnace heater is WOW-AWESOME.

Have a great week – and thank you for the comment and compliments.

I’m a new consultant and your blog has been immensely helpful and fascinating for me. Thank you so much for the time you put into this.

That is a huge compliment, and makes all the late-nights and blogging worthwhile. Keep trucking. . .do great client work.

Nice post…Platforms and digital intermediaries save time of people.

Business Advisory Services