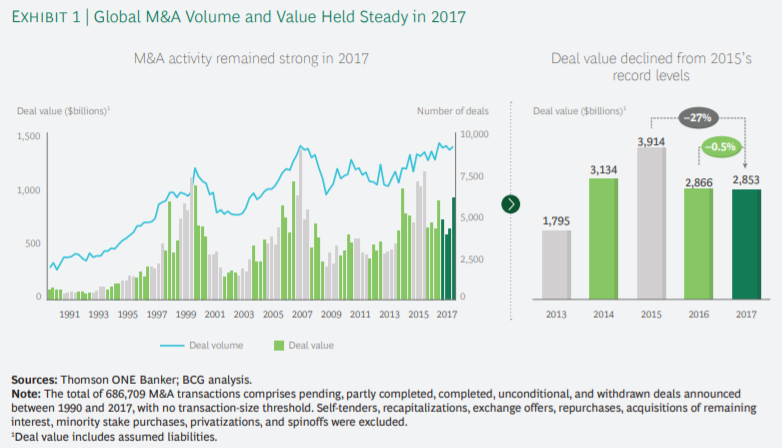

M&A continues to boom; 36,000 deals announced in 2017

BCG published a report on 2017 M&A called M&A: Synergies Take Center Stage (Sept 2018) here. (2.7Mb pdf). It’s 33 pages, and gives a run down of all the major deals and trends. Here’s my take.

In a nutshell, M&A is doing great, but valuations are high. The total deal value in 2017 was flat from 2016, but down 27% since the 2015 high of $3.9 trillion.

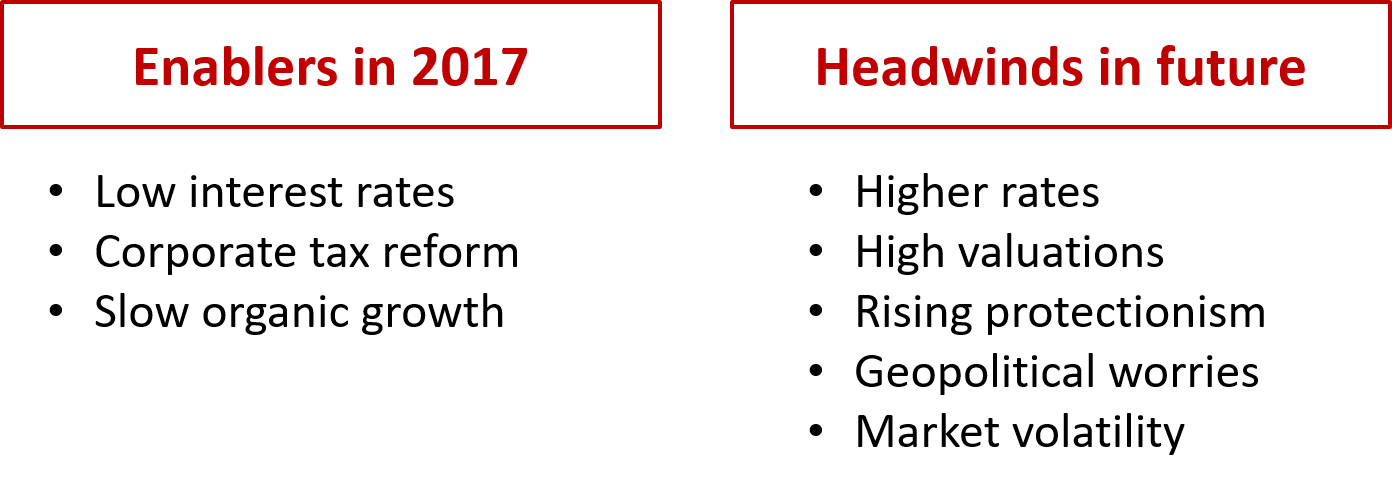

Honestly, the cost of money has been near zero for 10 years. It’s been a great environment for leverage and mergers: low interest rates, slow organic growth, corporate tax reform, and “unflinching investor support.” That said, there are quite a few headwinds for the M&A environment:

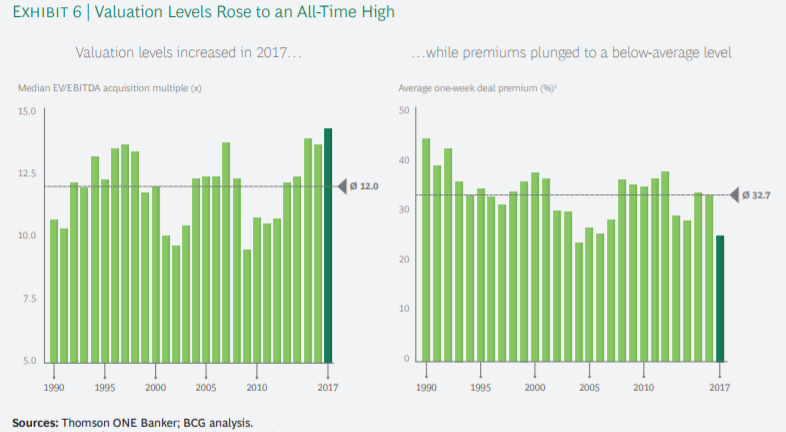

Valuations rising. . . now at 14.2x EBITDA

As I blogged about previously, there is a lot of private equity dry powder looking for good investments, so the purchase valuations are rising. Currently, it’s at 14x EBITDA, which makes the hurdle for the exit valuation that much harder. The number of PE deals increased to 5,800, and the percentage of deals by PE increased to 16% of total. In fact the percentage of mid-cap deals ($100M to $1B) increased from 48% to 62%. “In order to find attractive targets, PE firms seem to have lowered their target transaction size. They also increasingly engage in add-on acquisitions to their exiting portfolio companies.”

Synergies take center stage

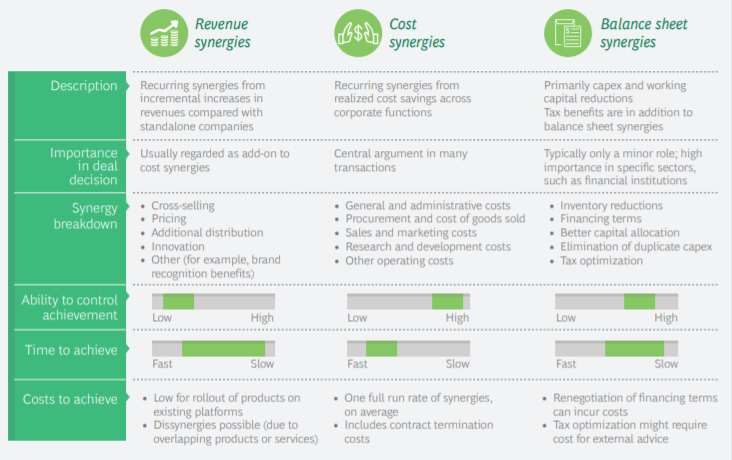

In the past synergies were a nice to have. However, with the rising purchase prices, BCG calls synergies “make or break” elements for mergers. Capturing synergies is difficult work. It’s easy to say “oh yeah, sure, we will merge the companies and get synergies”, but it is really adult-work to do the analysis, identify the potential risk, implement changes, and keep the customers happy. Synergies primarily come in three different flavors, shown below. As you can see, revenue synergies are difficult to capture, and often take a long time.

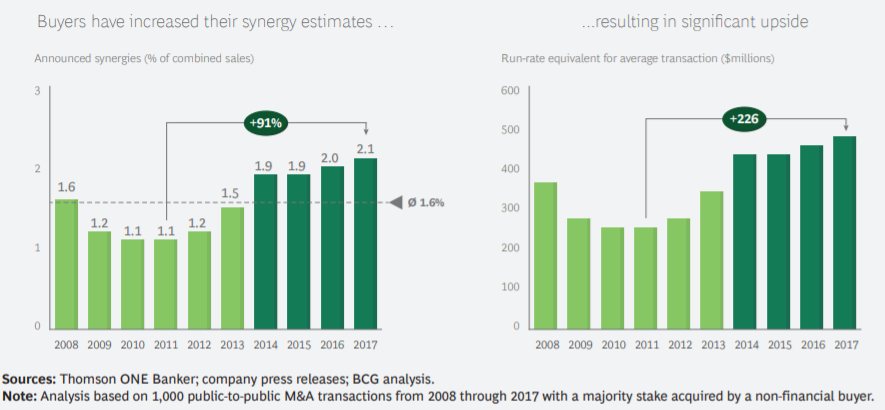

Looks like companies are making more synergies pronouncements at the time of the merger, and this is big money. BCG notes that a 1% improvement for these large deals can be $200M in run-rate of pretax annual operating income. Take $200M x 12 EBITDA multiple, an all of a sudden you are talking about $2.4 billion increase in enterprise value.

Synergies: Easier in some industries than others

Fascinating comparison of the industries / situations where synergies or more likely. They mention Meredith’s acquisition of Time magazine as a merger with synergy capture potential of 5% (e.g., reducing duplicate expenses, trimming down the corporate overhead, cross-selling media). In contrast, Royal Dutch Shell acquisition of BG Group was targeted for less than 1% synergy capture because there was limited overlap of their operations.

Six essentials for post-merger integration

Switching over to another BCG article entitled, Six Essentials for Achieving Post-Merger Synergies (May 2017) here. Here are the six major steps:

- Tightly link due-diligence and PMI – this makes enormous sense to have the same people who estimated the synergies, to have a strong part (read: accountability) to make it happen.

- Make the most of the clean teams – this group of independent professionals can really give the newly merged company a jump start on the integration process. Use them.

- Adopt stretch targets – these seems a little bit “high school coach” motivational, but they do emphasize the the learning curve, that costs will typically fall by ____% everytime the volume doubles. The more you do something, the more efficient you get.

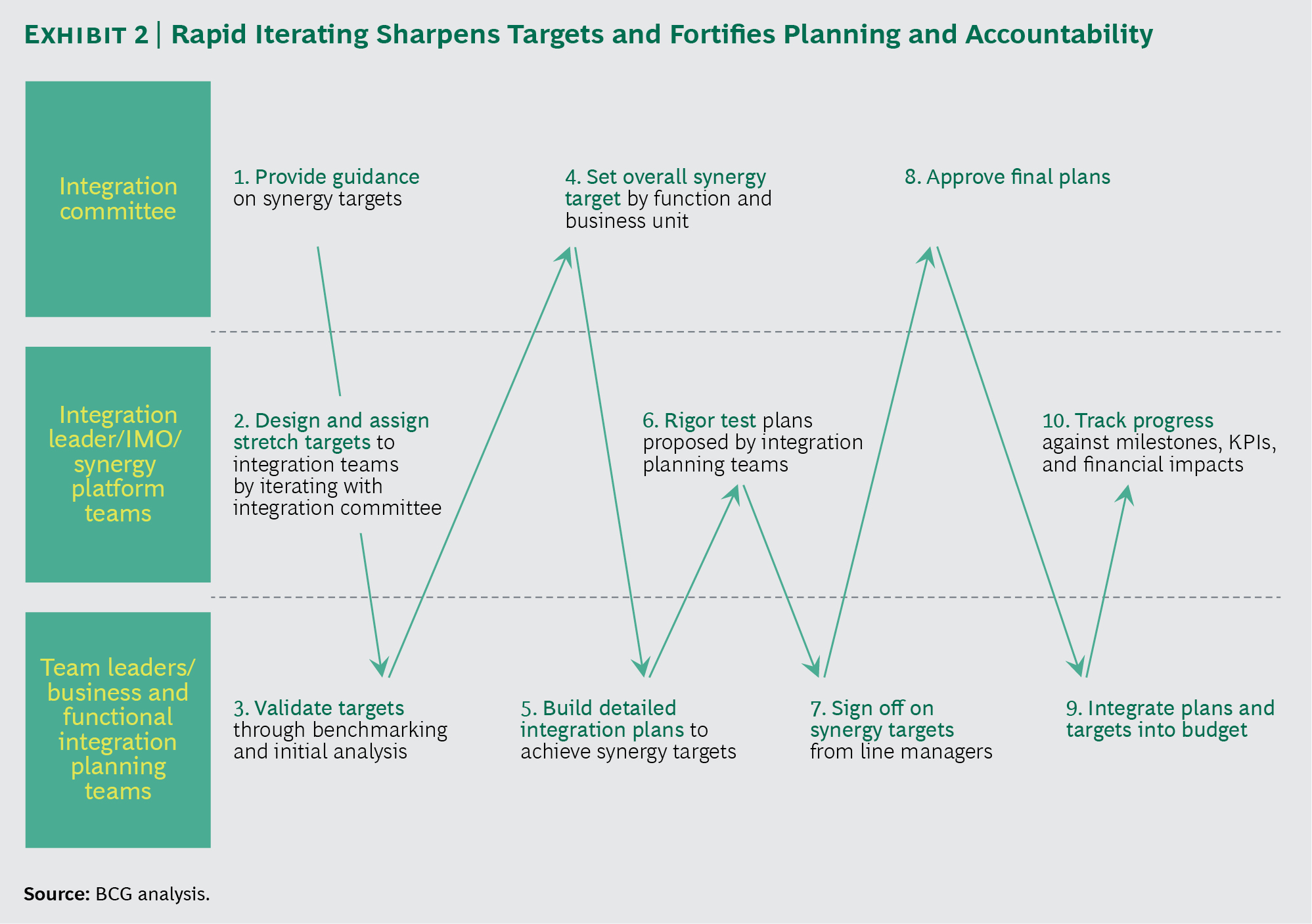

- Rapidly iterate targets – Look at the W chart shown below. Gotta appreciate consultants who create these clever, and (usually) useful ways to think about problems

- Pursue revenue synergies as diligently as cost synergies – to me, this seems like a hard one. Cost synergies are real, doable and more immediate. Revenue synergies often feel more abstract. Perhaps one exception is pricing – which is often overlooked, and a great way to drop profits directly to the bottom line

- Track progress through the PMI – this is probably the most important because, honestly, Drucker had it right: “What gets measured, gets managed.”

Related posts:

“that costs will typically call by ____% everytime the volume doubles.”<==Not sure I follow this statement…

Good catch. It is “fall” not call. Good catch. Thanks,